Contribution Margin Ratio Formula Per Unit Example Calculation

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. The 60% CM ratio implies the contribution margin for each dollar of revenue generated is $0.60. The insights derived post-analysis can determine the optimal pricing per product based on the implied incremental impact that each potential adjustment could have on its growth profile and profitability.

Everything You Need To Master Financial Modeling

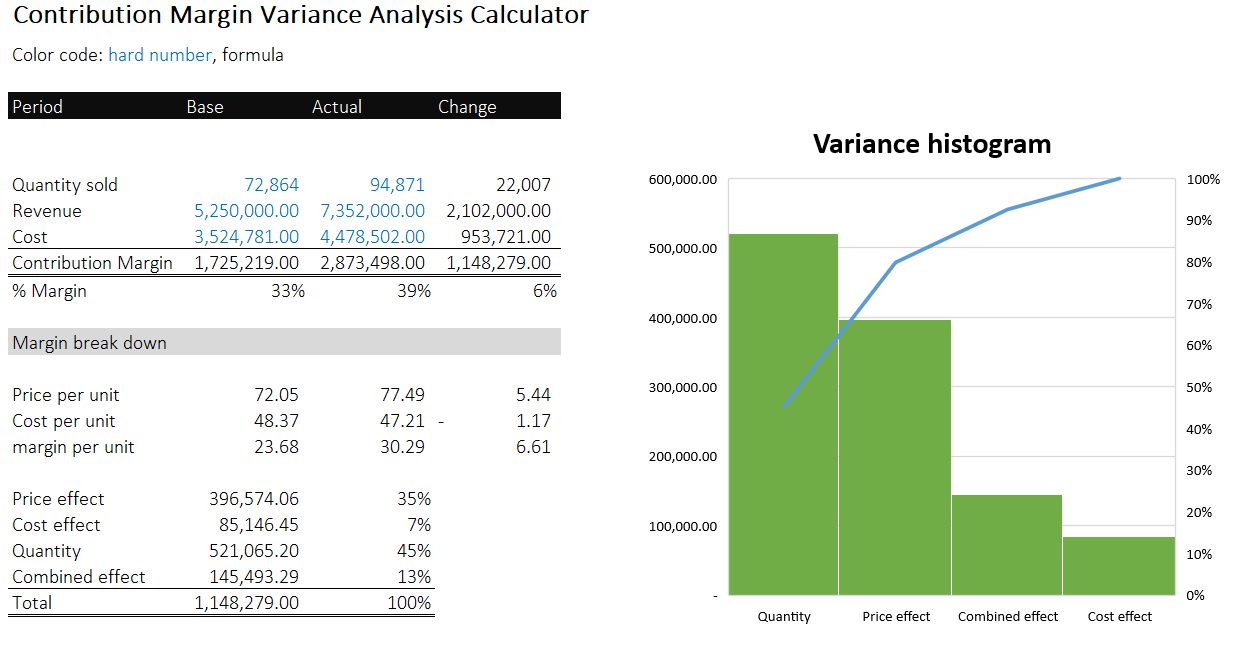

Contribution margin metrics, like the contribution margin per unit and contribution margin ratio, offer profound insights into a company’s cost structure and profitability. By subtracting variable costs from the selling price per unit, these metrics highlight how much each product contributes to covering fixed costs and generating profit. This information, often detailed in an income statement, is crucial for evaluating the financial health of a business. The how to fire a horrible client is a vital tool for businesses seeking to analyze their profitability on a per-product basis.

Contribution Margin: Definition, Overview, and How To Calculate

For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

How confident are you in your long term financial plan?

Contribution margin is the remaining earnings that have not been taken up by variable costs and that can be used to cover fixed costs. Profit is any money left over after all variable and fixed costs have been settled. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs. The product revenue and number of products sold can be divided to determine the selling price per unit, which is $50.00 per product. The contribution margin is important because it gives you a clear, quick picture of how much "bang for your buck" you're getting on each sale.

Step 2 of 3

Keeping track of changes in variable costs or selling prices per unit is essential for the accuracy of the calculation. Additionally, understanding the financial ratios that emerge from this analysis can guide strategic decisions. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit. The break even point (BEP) is the number of units at which total revenue (selling price per unit) equals total cost (fixed costs + variable cost).

Variable cost

- Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc).

- Such fixed costs are not considered in the contribution margin calculations.

- The concept of contribution margin has been central to managerial accounting and financial analysis for decades, providing a straightforward way to evaluate the profitability and efficiency of sales.

- You'll often turn to profit margin to determine the worth of your business.

It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

Designed with business owners in mind, it takes into account various factors such as sales revenue, variable costs, and the number of units sold to provide a clear picture of your contribution margin. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue.

The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. Contributions margin ratio (also known as gross profit ratio) is one of the most important financial ratios. It measures how profitable a company is with each dollar of sales revenue. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. The formula to calculate the contribution margin is equal to revenue minus variable costs.

It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it's a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits.

Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit's cost as the number of units sold increases. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs.

Aside from the uses listed above, the contribution margin's importance also lies in the fact that it is one of the building blocks of break-even analysis. With that all being said, it is quite obvious why it is worth learning the contribution margin formula. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low.